31-01-2024 | Noticias-en

With the intention of monitoring correct compliance with tax and customs obligations, the Tax Administration Service (“SAT”) released its Master Plan for the year 2024.

The Master Plan strategy is focused on 3 main axes: taxpayer service, collection and inspection.

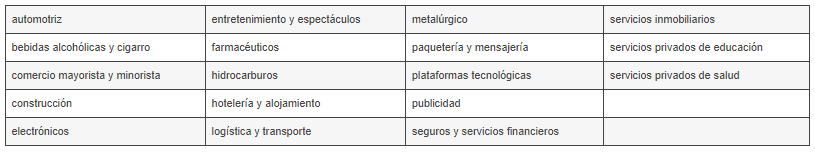

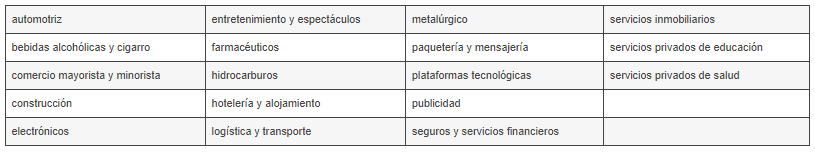

For the collection and inspection strategy, during this year, the SAT will concentrate its reviews on the following economic sectors:

On the other hand, the concepts and behaviors of special interest to the tax-customs authority will deal with the following:

- Use of private pension plans, similar, subcontracting and RESICO;

- Improper application of balances in favor, VAT rate 0%, non-object VAT and import VAT;

- Corporate restructuring and tax effects in spin-offs, mergers and international restructurings;

- Disposals of shares and intangibles;

- Review of partners and shareholders in operations associated with restructuring;

- Fiscal losses and incentives, as well as REFIPRES;

- Foreign trade operations and anti-smuggling operations;

- Misuse of treaty benefits and origin verification;

- IEPS Accreditation;

- Non-compliance with IMMEX Programs, temporary imports and import permits;

- Undervaluation based on incorrect customs valuation, tariff classification and inconsistent declarations in the petitions;

- Financing, capitalization of liabilities and distribution of profits;

- Trusts and credit intermediation companies;

Volumetric controls; and

- Technological, commerce and electronic collection platforms.

The SAT will implement various activities, among which the following stand out:

- Strengthen attention to taxpayers.

- Guide and accompany debtors of tax credits for the regularization of their debts and the voluntary and timely compliance with their tax obligations.

- Apply benefits in cases of self-correction due to audits.

Improvements in declarations.

- Use of artificial intelligence for better planning in collection processes, with the purpose of reviewing certain items, among which are: outsourcing of payroll payments, inappropriate applications of balances in favor of VAT, foreign trade taxes, among others .

Finally, to avoid bad fiscal practices, the authority will carry out collection and inspection actions aimed at combating irregularities in tax and customs matters, such as:

- Targeting taxpayers with tax credits due to collection potential.

- Strengthening “persuasive” actions for the collection of tax credits.

- Increase in collection actions for taxpayers with unsecured tax debts.

- Coordination with Federal Entities to increase audits, operations, inspection and collection of tax debts.

- Restriction of digital seal certificates to taxpayers with simulated operations.

- Monitoring of taxpayers who do not comply with the deadlines in the payment of their tax obligations.

- Derived from the above, it is clear that through the Master Plan for fiscal year 2024, the tax authorities seek to continue increasing collection efficiency through inspection and management actions; focusing this year on certain specific industries, concepts and behaviors.

For more information contact:

Juan José López de Silanes | Partner Basham, Ringe and Correa | lopez_de_silanes@basham.com.mx

20-11-2023 | Noticias-en

The initiative seeks to avoid duplication in the payment of taxes and also prevent tax evasion of income and wealth taxes.

On November 16, 2023, the National Congress approved the agreement between Chile and the United States by which the “Agreement between the Government of the Republic of Chile and the Government of the United States of America to Avoid Double Taxation and to Prevent Tax Evasion in Relation to Income and Property Taxes and its Protocol.”

The entry into force of the agreement will occur when it is ratified by the President of the Republic of Chile and the exchange of notes between Chile and the United States takes place.

Thus, the provisions of the agreement will come into force in accordance with the following detail:

Withholding taxes at source, with respect to amounts paid or accrued, will take effect on or after the first day of the month following the entry into force of the Agreement.

Other taxes will take effect starting January 1 of the year following the entry into force of the Agreement.

Regarding the rules for exchanging information, they will govern from the entry into force of the Agreement, without making distinction to the tax period to which the information refers.

This is a fact that will undoubtedly favor commercial exchange between both countries. Among its main tax implications we can find the following:

Capital gains: The rate is reduced from the current 35% to 16%, provided that the transferor has not owned, within the 12 months preceding the transfer, more than 50% of the capital of the company with residence in Chile.

Interests: The maximum rates currently in force are limited (Chile 35%, United States 30%). The maximum rate will be 10% as a general rule and may be as high as 4%. However, during the first two years of validity of the Agreement it will be a rate of 15%.

Dividends: A maximum rate of 5% is established if the beneficiary of the dividends is a company that owns at least 10% of the voting shares of the company that pays the dividends and 15% in other cases. In the case of Chile, given our semi-integrated system, the maximum rate will not apply to the extent that the First Category Tax can be used entirely as a credit and the Additional Tax rate does not exceed 35%.

Use of credits: The corporate tax paid or withheld in the United States may be used in Chile as a credit.

Information exchange: A mechanism is contemplated for information requirements and exchanges.

For more information you can contact :

Francisca Franzani | Compliance Group Director | ffranzani@az.cl

16-11-2023 | Noticias-en

The Constitutional Court has just ruled on a fragment of the new tax reform, specifically an article that included mining and oil companies. The article established the basis on which companies that exploit natural resources had to declare income. However, the high court declared that this adjustment is not in accordance with the constitution. Of the 15 lawsuits filed against the law, this was one of the two that the high court agreed to study, finally declaring it unenforceable.

The article of the law defined the basis on which companies that exploit non-renewable natural resources had to declare income. These types of companies have to transfer to the State a percentage of their profits in consideration, the so-called royalties. But in its article 19, the tax reform ensured that these royalties do not constitute a deductible from income tax, nor a cost or expense, but also that they must be recognized to the State through a tax percentage.

In April of this year, the Attorney General of the Nation, Margarita Cabello Blanco, had spoken out about this article, arguing that for her it was not “legitimate for Congress to prevent companies from deducting that payment.” In the concept that she sent to the Court, she explained that this type of use of natural resources generated a social and ecological impact that, until now, is compensated to the community through royalties. For her, these should be understood as expenses or costs associated with extractive activities, which when paid should translate into a deductible or discount as it currently works.

Source: El Espectador

For further information, contact:

Oscar Tutasaura | Partner Posse Herrera Ruiz | oscar.tutasaura@phrlegal.com

25-07-2023 | Noticias-en

On June 22, 2018, the Decree was published in the Official Gazette of the Federation, by which the “Convention to Homologate the Tax Treatment provided for in the Agreements to Avoid Double Taxation signed between the States Parties to the Framework Agreement of the Pacific Alliance” (hereinafter “the Convention”). The Pacific Alliance was established as a mechanism for political, economic and commercial articulation between Chile, Colombia, Peru and Mexico.

In this sense, the purpose of the Convention is to modify and standardize the bilateral agreements to avoid double taxation signed between Chile, Colombia, Peru and Mexico, in order to grant a specific tax treatment to the income obtained by the pension funds recognized by these Contracting States. The provisions of the Convention will begin their application as of January 1, 2024.

Specifically, the Convention standardizes and modifies the tax treatment applicable to pension funds resident in the Contracting States, with respect to the income they receive from interest and capital gains , in accordance with the following provisions:

- Application of a maximum rate of 10% of income tax to the gross amount of interest from a source of wealth of any of the Contracting States.

- In the event that the applicable tax under domestic legislation is lower or exempt, the application of Article 11 of the Tax Agreements is recognized.

- Regarding the income obtained from capital gains derived from the sale of shares , carried out through a stock exchange that is part of the Latin American Integrated Market (MILA), exclusive taxation is granted to the State of residence of the pension fund.

- The pension funds recognized by the Contracting States will be considered beneficial owners of the income they receive.

For more information contact to:

Juan José López de Silanes | Partner Basham, Ringe y Correa | lopez_de_silanes@basham.com.mx

31-05-2023 | Noticias-en

In this article, we will examine the reality of tax compliance in countries such as Argentina, Chile, Uruguay, Paraguay, Bolivia, Peru, Colombia, Ecuador, Central America, Mexico, and the United States, and the measures that have been adopted to address the issue.

Tax compliance is a critical issue in every country in the world. Taxes are a vital source of revenue for governments, and failure to comply with tax obligations can have serious consequences for both individuals and businesses. In recent years, many Latin American countries have implemented measures to improve tax compliance and reduce tax evasion.

In addition to being a fundamental element for the administration of any country, it is a fundamental legal and ethical requirement for any company because they have the responsibility to comply with their tax obligations and pay the corresponding taxes in each jurisdiction. Failure to comply with tax can have serious consequences for a business, including fines, penalties, litigation, and damage to its reputation. Lack of tax compliance can affect the financial stability and sustainability of any company.

In Argentina , tax compliance has been a critical issue for companies for decades. Tax evasion and non-compliance with tax obligations are persistent problems that negatively affect the country’s economy. However, in recent years, many Argentine companies have taken steps to improve their tax compliance and reduce the risk of non-compliance. One of the main measures that organizations have taken is the implementation of tax compliance management systems that make it possible to monitor and manage their tax obligations more effectively, and reduce the risk of errors and omissions.

Chile , for its part, has a complex tax system that requires a high level of compliance by companies. In addition, the Chilean tax administration is very active in identifying and sanctioning companies that do not comply with their tax obligations. Another important aspect of tax compliance in Chile is cooperation with tax authorities. Many companies have established closer relationships with the tax administration and have implemented measures to ensure transparency and accuracy in their tax returns.

In Uruguay , Paraguay and Bolivia , tax compliance is also a critical issue for companies. Although the tax systems of these countries may be less complex than those of Argentina and Chile, compliance with tax obligations is still essential for the proper functioning of companies. In recent years, greater emphasis has been placed on auditing and identifying companies that do not comply with their tax obligations.

The tax systems of Peru , Colombia and Ecuador are complex and the tax administrations are very active in the examination and sanction of companies that do not comply with their tax obligations. It is common for the three jurisdictions that companies that operate there must invest in training programs for their employees and in tax compliance management systems to guarantee compliance with their obligations and reduce the risk of sanctions and fines.

The state of tax compliance in Central America varies from country to country, but in general, tax compliance is a critical issue for companies in the region. The tax systems in Central America are complex and the tax administrations are very active in examination and penalization.

In countries like Costa Rica and Panama , companies are required to file tax returns and pay taxes on income, value added, and social security contributions. In addition, companies must comply with certain information and documentation requirements, and tax administrations have implemented measures to improve inspection and penalize companies that do not comply with their tax obligations. It is important to note that international tax information exchange agreements and cooperation between tax administrations from different countries are becoming more frequent in the region, increasing the need for rigorous tax compliance.

In Mexico , the Mexican Tax Administration (SAT) is known for being rigorous in the examination of companies and individuals, and has implemented various measures in recent years to improve tax compliance, such as electronic invoicing and electronic accounting. The implementation of the Federal Tax Code in 2020 and the new Asset Forfeiture Law have further strengthened the legal framework and sanction mechanisms in tax matters. Mexican companies must pay attention to their tax obligations and take steps to ensure compliance, reduce the risk of penalties and fines, and improve their business reputation.

On the other hand, in the United Statess, the Internal Revenue Service (IRS), the US tax agency, is very active in monitoring and sanctioning companies that do not comply with their tax obligations, especially with regard to federal and state taxes. Businesses must file tax returns and pay income, employment, property, sales, and other taxes, as well as meet certain reporting and documentation requirements, such as filing W-2 and 1099 forms The Foreign Account Tax Compliance Act (FATCA) and the Foreign Account Tax Compliance Act (FBAR) are important regulations that companies doing business abroad must be aware of. Local companies must meet their tax obligations,

Although the region has different realities in terms of the maturity in the incorporation of compliance programs within companies and commercial organizations, it is important to highlight that in most of the countries of the continent there is a common denominator that is governed by the interest of governments to increase efforts to control the tax activities of all sectors of the economy.

09-05-2023 | Noticias-en

Through Resolution No. NAC-DGERCGC23-00000008, the SRI extended the term for the presentation of annexes and tax declarations due in March 2023, without generating fines and interest, according to the following:

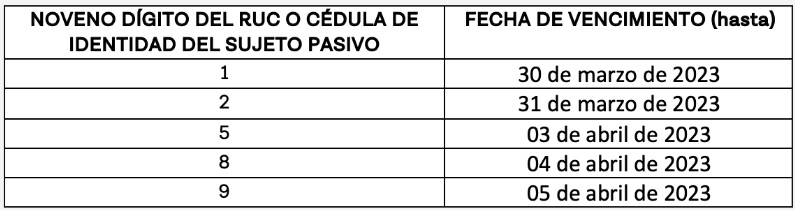

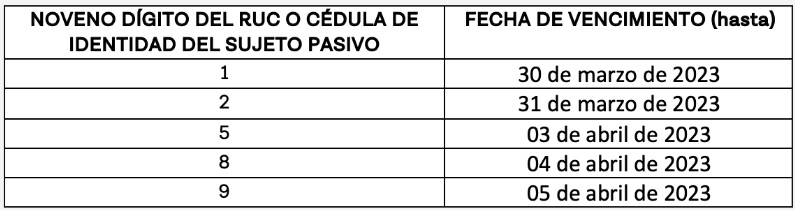

Natural persons, undivided estates and companies belonging to the General Regime, whose ninth digit of the RUC is 2 and 3, may submit and/or pay their Income Tax return corresponding to fiscal year 2022, as well as the annexes and returns for other obligations that mature in March 2023, according to the following schedule:

Likewise, the taxpayers belonging to the RIMPE popular businesses and entrepreneurs, whose ninth digit of the RUC is 1, 2, 5, 8 and 9, may present and/or pay their Income Tax return corresponding to the fiscal year 2022, as well as the annexes and declarations for other obligations whose maturity is in March 2023, according to the following calendar:

Finally, taxpayers obliged to present the declaration of the Contribution destined to the financing of comprehensive cancer care, whose due date is March 13 and 14, may present the declaration and payment until March 28, 2023.

*Reference: This Resolution has been in force since March 13, 2023, the date it was signed.

For more information contact:

Maria Rosa Fabara | Partner Bustamante Fabara | mrfabara@bustamantefabara.com