Through Resolution No. NAC-DGERCGC23-00000008, the SRI extended the term for the presentation of annexes and tax declarations due in March 2023, without generating fines and interest, according to the following:

Natural persons, undivided estates and companies belonging to the General Regime, whose ninth digit of the RUC is 2 and 3, may submit and/or pay their Income Tax return corresponding to fiscal year 2022, as well as the annexes and returns for other obligations that mature in March 2023, according to the following schedule:

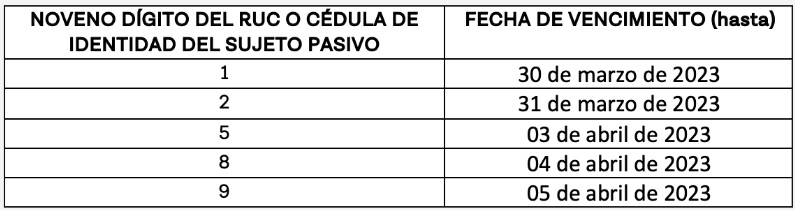

Likewise, the taxpayers belonging to the RIMPE popular businesses and entrepreneurs, whose ninth digit of the RUC is 1, 2, 5, 8 and 9, may present and/or pay their Income Tax return corresponding to the fiscal year 2022, as well as the annexes and declarations for other obligations whose maturity is in March 2023, according to the following calendar:

Finally, taxpayers obliged to present the declaration of the Contribution destined to the financing of comprehensive cancer care, whose due date is March 13 and 14, may present the declaration and payment until March 28, 2023.

*Reference: This Resolution has been in force since March 13, 2023, the date it was signed.

For more information contact:

Maria Rosa Fabara | Partner Bustamante Fabara | mrfabara@bustamantefabara.com