29-07-2024 | Noticias-en

On July 24, the Central Bank of Paraguay (BCP) approved, through resolution No. 12, the “Regulation of the QR Generation Standard for Electronic Payments in Paraguay”. This regulation establishes the requirements for the generation and use of QR codes in electronic payments within the country.

Key aspects of the new regulation

QR Code: A two-dimensional quick response barcode containing information necessary for payment services, which can be scanned, processed and transmitted securely by a device.

Dynamic QR Code : Code presented by the merchant that includes your data to complete the payment and the amount to be paid.

Static QR Code : Code presented by the merchant that includes your details to complete the payment, but not the amount to be paid.

EMV® QRCPS : QR codes developed according to Europay, Mastercard and Visa Common QR standards and guidelines.

Standardization requirements

Dynamic and static QR codes must be based on EMV® QRCPS standards.

QR code generation must follow the guidelines of the PY-QR Code Implementation Guide.

QR codes must include the PY-QR logo.

Requirements for payment service providers (PSPs)

PSPs that use electronic payments with QR code must register with the BCP, in accordance with the instructions and requirements established by the Sub-General Management of Financial Operations (SGGOF). The deadline to comply with these requirements and complete the corresponding registration is June 30, 2025.

The SGGOF will issue the PY-QR code implementation guide, which will cover all transactions related to the generation of QR codes for electronic payments in the country.

For more information

For additional questions or more details on how this Regulation may affect your business, you can contact consultas@ferrere.com.

22-07-2024 | Noticias-en

In June 2024, the U.S. Supreme Court issued two landmark rulings, Securities & Exchange Commission v. Jarkesy and Loper Bright Enterprises v. Raimondo , each of which has broad implications for the powers of the executive branch. While neither decision specifically addressed the powers of agencies focused on national security or foreign policy, such as the Department of Commerce’s Bureau of Industry and Security (BIS) or the Department of the Treasury’s Office of Foreign Assets Control (OFAC), some of the broader language in these decisions could call into question the potential for these agencies, which are often granted broad regulatory deference and sweeping enforcement powers, to suffer an erosion of their authority.

Jarkesy – Let’s Leave Common Law Claims to the Courts, Not the Agencies

On June 27, 2024, the Court issued a decision invalidating the Securities and Exchange Commission’s (SEC) statutory authority to impose civil penalties for fraud violations in a forum outside of a federal court. The case concerned whether the SEC could impose a civil penalty against a defendant accused of fraud through the SEC’s internal administrative forum, rather than in federal court. Although Congress authorized the SEC to do so internally, the Court ruled that the SEC’s civil penalty action implicated the Seventh Amendment to the U.S. Constitution, which provides for a right to a jury trial in “common law suits.” The Court’s decision focused on the fact that civil monetary penalties had traditionally been imposed by common law juries, particularly in cases involving common law fraud.

Jarkesy Exception – Public Rights: Over the past 50 years, the Court has carved out an exception to the Seventh Amendment’s right to trial by jury in cases involving “public rights.” The Court made clear in its opinion in Jarkesy that this exception cannot be allowed to swallow up the general presumption in favor of a right to trial by jury before an Article III court and must be limited to cases analogous to those traditionally excepted from the right to trial by jury, including (but not appearing to be limited to) “the collection of revenue, the enforcement of customs laws, immigration, and the granting of public benefits.” Beyond this list of traditionally excepted “public rights,” the Court did not elaborate on a test for determining whether a claim falls within the public rights exception.

Loper Bright – Ambiguous Statutes Do Not Automatically Imply Deference by Agencies

On June 28, 2024, the Supreme Court issued a ruling that overturned the nearly 40-year-old doctrine known as Chevron deference , which required courts to defer to an executive agency’s reasonable interpretation of ambiguous statutes, even if the Court would have found a different interpretation to be best. Loper Bright reversed Chevron , holding that courts must, in interpreting an ambiguous statute, exercise their “independent judgment” in deciding the proper interpretation of the statute, and may not simply defer to whatever agency interpretation is permissible.

The Court rejected the view that agencies are experts best suited to interpret statutory ambiguities, noting instead that courts can do their “ordinary work” of interpreting statutes “with due respect for the views of the Executive Branch,” which can help inform a court’s judgment. This last point is important: While courts will no longer defer to any “permissible” interpretation of an ambiguous statute, they are still permitted to consider and give great weight to a well-reasoned interpretation of the statute by the agency. The better the agency’s reasoning, the more deference it will be given, and the more likely a court will find its reasoning to be the correct interpretation of an ambiguous statute.

Jarkesy and Loper Bright in the context of national security

Neither Jarkesy nor Loper Bright cited any explicit “national security” or “foreign affairs” exceptions in their respective opinions. Thus, unless challenged, the rulings in those cases may be applicable to agencies that administer and enforce national security-focused regulations, including those in the Treasury and Commerce Departments. Below, we discuss the potential implications of the cases for national security-focused agencies:

Jarkesy, in particular, creates potential limitations on agencies’ enforcement power regarding sanctions, export controls, and anti-money laundering (AML) violations, among others. Enforcement agencies such as OFAC, BIS, the Financial Crimes Enforcement Network (FinCEN), and the Committee on Foreign Investment in the United States (CFIUS) rely on authorities within their regulations to issue civil monetary penalties for potential violations.

OFAC, for example, can take a range of administrative actions pursuant to its regulations, such as unilaterally imposing civil monetary penalties or negotiating settlements with a potential violator of U.S. sanctions. Such broad enforcement mechanisms may leave a potential violator with little bargaining power with national security agencies and also serve to deter private actors from committing future violations.

It is unclear whether Jarkesy’s largely undefined “public rights” exception includes cases involving matters of national security or foreign affairs, particularly in cases involving the administrative imposition of monetary penalties imposed for fraudulent or willful conduct that may have required a jury trial at common law. Practitioners and their clients alike should pay close attention to future lawsuits challenging administrative penalties and, if appropriate, consider challenging such penalties based on the Jarkesy decision.

A potential increase in civil challenges to OFAC, BIS, FinCEN and CFIUS regulations .

Historically, there have been few instances in which private actors have successfully challenged national security agencies’, such as OFAC’s, interpretations of statutes within their area of expertise. Moreover, Loper Bright left intact the Court’s 2019 decision in Kisor v. Wilkie, which held that some deference should be given to an agency’s interpretation of its own ambiguous regulations, provided that the regulations are truly ambiguous and the agency’s interpretation is reasonable and, in fact, a product of its own expertise. Reversing the Chevron doctrine and limiting agency deference could prompt further limitations to the Kisor rule, thereby providing an easier path for potential litigants to challenge national security agencies’ increasingly numerous and complex regulations.

All of this is taking place against the backdrop of a raft of new regulations or notices of proposed rulemaking (NPRMs) issued by the Biden administration regarding technology-related investments to and from China. While such rules and NPRMs could go into effect in the near future, they are likely to face challenges, according to Jarkesy and Loper Bright.

For more information, please contact:

Timothy P. O’Toole, totoole@milchev.com, 202-626-5552

Laura Deegan, ldeegan@milchev.com, 202-626-5942

Caroline J. Watson, cwatson@milchev.com, 202-626-6083

Melissa Burgess, mburgess@milchev.com, 202-626-5914

Manuel Levitt, mlevitt@milchev.com, 202-626-5921

Annie Cho, acho@milchev.com, 202-626-1570

19-07-2024 | Noticias-en

The Plenary Session of the Congress of the Republic unanimously approved the opinion of Bills No. 2942/2022, 3131/2022 and 3541/2022 (the “Opinion”), which modifies literal e. of article 58.1 of Law No. 29571, Consumer Protection and Defense Code (the “Code”), regarding the prohibition of spam calls.

With this amendment to the Code, companies would be prohibited from using call centers , telephone calling systems, sending text messages to cell phones or mass electronic messages to offer products or services to consumers, unless the latter, on their own initiative, have given their free, prior, informed, express and unequivocal consent to be contacted to receive commercial or advertising communications. This includes the prohibition of making calls to establish initial contact with the consumer and request their consent, which is currently permitted by the Code.

The Opinion also specifies that consent may be revoked with immediate effect and without giving any reason, at any time and in accordance with personal data protection regulations. Furthermore, it provides that the violation of this prohibition or its revocation is a very serious infringement.

Finally, the Opinion incorporates article 58.3 into the Code, the text of which states that in order to guarantee consumer protection against aggressive or deceptive commercial methods, the State establishes rules for the proper use of sending messages and calls on telecommunications networks. For the application of this provision, the Sole Final Complementary Provision of the Opinion states that within a period of 60 calendar days – counted from its entry into force – the Executive Branch will establish additional regulations that grant special telephone numbers to providers, security methods and validation techniques so that users can identify the calls they receive.

You can access the Opinion .

For more information on this topic or any questions:

innovacion@cpb-abogados.com.pe

15-07-2024 | Noticias-en

By Decree No. 852 of July 5, 2024 (the “Decree 852”), the Ministry of Environment and Sustainable Development (the “MADS”) modified the environmental licensing regime for energy generation projects from non-conventional sources (“FNCER”).

What changes does Decree 852 introduce?

Decree 852 introduced the following modifications:

- Change in the powers of the ANLA and the CAR.

- Introduction of a new definition.

- Transitional regime regarding the change of powers.

Download the newsletter here .

12-07-2024 | Noticias-en

On May 25, the National Secretariat for the Fight against Money Laundering and the Financing of Terrorism (SENACLAFT) published the Guide of signs and indicators of money laundering risk for Non-Financial Obligated Subjects in the use of virtual assets. The objective of the Guide is to facilitate the evaluation of risks when using virtual assets.

Article 19 of Law 19,574 establishes a risk-based approach, establishing that obligated parties must apply enhanced due diligence procedures in those cases in which new technologies that promote anonymity are used. In this sense, in operations where virtual assets are used, the obligated party must necessarily apply enhanced due diligence measures.

SENACLAFT highlights that at the time of publication of the Guide, the activity of virtual service providers, as well as the use of virtual assets, is not legally regulated in the country, a situation that may change in the short term.

12-07-2024 | Noticias-en

On June 11, 2024, Interministerial Agreement No. MCEIP-MDT-2024-001-AI was signed between the Ministry of Labor and the Ministry of Production, Foreign Trade, Investments and Fisheries. The new regulations stipulate that companies wishing to obtain the “Violet Seal” must take into account principles, norms, actions and indicators that demonstrate the employer’s commitment to eliminate barriers, wage gaps, situations of violence, harassment and discrimination, promotion of promotions and conciliation with care tasks, elimination of discriminatory permits and breastfeeding, as well as the promotion of equality in collective bargaining.

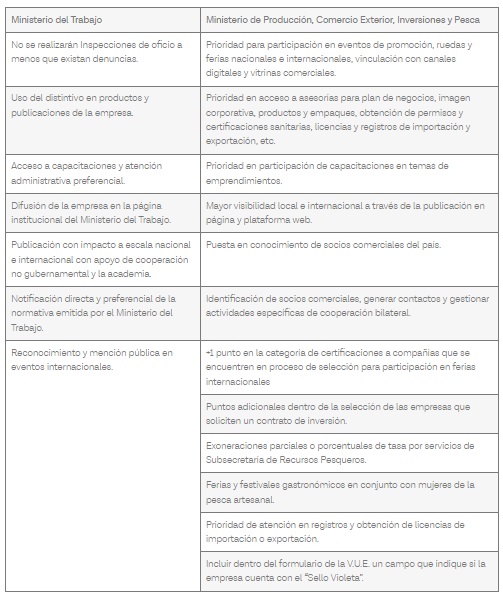

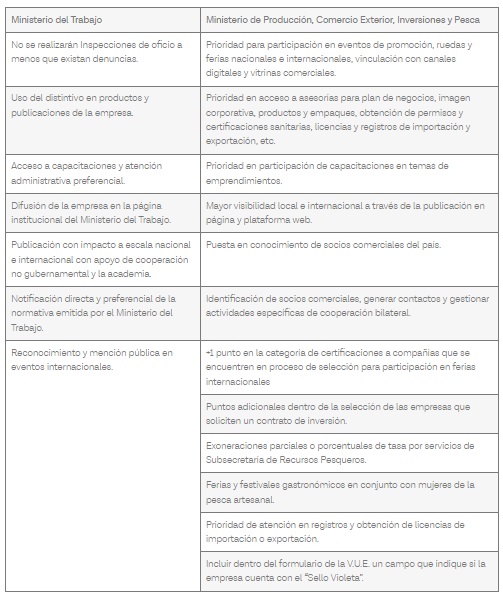

Both ministries announced that they will grant the following benefits to companies that obtain the “Violet Seal”:

Procedure for obtaining the “Violet Seal”:

To obtain this badge, companies must submit the following documents through the Document Management System of the Ministry of Labor:

Application form for obtaining the “Violet Seal” Distinctive.

Payroll of Workers.

Notice of Entry to the IESS of the workers.

Payment roles for the last three months of the workers.

Proof of payment of the workers’ reserve funds; delivery of supplies, instruments; delivery of clothing.

Document of not being in arrears or maintaining glosses or credit titles in the certificate of compliance with obligations issued by the IESS.

Documents that demonstrate compliance with the Program for the Prevention of Psychosocial Risks registered in the Ministry of Labor.

Comply with the equality policies and the guidelines provided by the Ministry of Labor for compliance with these.

Not having been sanctioned for a complaint from a worker due to discrimination, workplace harassment, sexual harassment at work or violence against women in the last three (3) years.

Equality Plan Registry.

Job Manual in accordance with current regulations.

Human Talent/Human Resources List that includes promotions and professional development.

Registry of training carried out in the last year.

Implementation of current regulations to eliminate harassment, violence and discrimination.

Within 60 days of submitting the documentation, the certifying entity will issue a report analyzing the submitted documentation and will decide whether to approve or deny the granting of the “Violet Seal”. Once the Ministry of Labor knows the final approval report, it will grant the “Violet Seal” Resolution and its distinctive mark.

The duration of this badge will be 1 year from the date of delivery and may be renewed for equal periods indefinitely.

Finally, the Ministry of Labor reported that it will delegate the review of the requirements and certification of this distinction to entities that meet the requirements set forth in the regulations. Likewise, labor inspections may be carried out to verify the effective application of the actions implemented in the prevention, promotion and guarantee of women’s rights in the workplace.

If you require additional information, please contact the email laboral@bustamantefabara.com