With the intention of monitoring correct compliance with tax and customs obligations, the Tax Administration Service (“SAT”) released its Master Plan for the year 2024.

The Master Plan strategy is focused on 3 main axes: taxpayer service, collection and inspection.

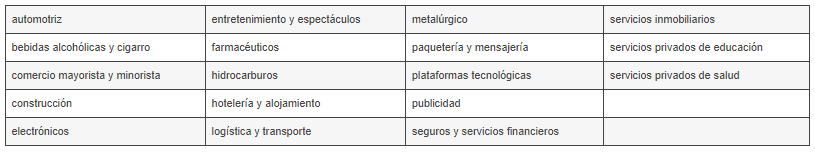

For the collection and inspection strategy, during this year, the SAT will concentrate its reviews on the following economic sectors:

On the other hand, the concepts and behaviors of special interest to the tax-customs authority will deal with the following:

- Use of private pension plans, similar, subcontracting and RESICO;

- Improper application of balances in favor, VAT rate 0%, non-object VAT and import VAT;

- Corporate restructuring and tax effects in spin-offs, mergers and international restructurings;

- Disposals of shares and intangibles;

- Review of partners and shareholders in operations associated with restructuring;

- Fiscal losses and incentives, as well as REFIPRES;

- Foreign trade operations and anti-smuggling operations;

- Misuse of treaty benefits and origin verification;

- IEPS Accreditation;

- Non-compliance with IMMEX Programs, temporary imports and import permits;

- Undervaluation based on incorrect customs valuation, tariff classification and inconsistent declarations in the petitions;

- Financing, capitalization of liabilities and distribution of profits;

- Trusts and credit intermediation companies;

Volumetric controls; and - Technological, commerce and electronic collection platforms.

The SAT will implement various activities, among which the following stand out:

- Strengthen attention to taxpayers.

- Guide and accompany debtors of tax credits for the regularization of their debts and the voluntary and timely compliance with their tax obligations.

- Apply benefits in cases of self-correction due to audits.

Improvements in declarations. - Use of artificial intelligence for better planning in collection processes, with the purpose of reviewing certain items, among which are: outsourcing of payroll payments, inappropriate applications of balances in favor of VAT, foreign trade taxes, among others .

Finally, to avoid bad fiscal practices, the authority will carry out collection and inspection actions aimed at combating irregularities in tax and customs matters, such as:

- Targeting taxpayers with tax credits due to collection potential.

- Strengthening “persuasive” actions for the collection of tax credits.

- Increase in collection actions for taxpayers with unsecured tax debts.

- Coordination with Federal Entities to increase audits, operations, inspection and collection of tax debts.

- Restriction of digital seal certificates to taxpayers with simulated operations.

- Monitoring of taxpayers who do not comply with the deadlines in the payment of their tax obligations.

- Derived from the above, it is clear that through the Master Plan for fiscal year 2024, the tax authorities seek to continue increasing collection efficiency through inspection and management actions; focusing this year on certain specific industries, concepts and behaviors.

For more information contact:

Juan José López de Silanes | Partner Basham, Ringe and Correa | lopez_de_silanes@basham.com.mx