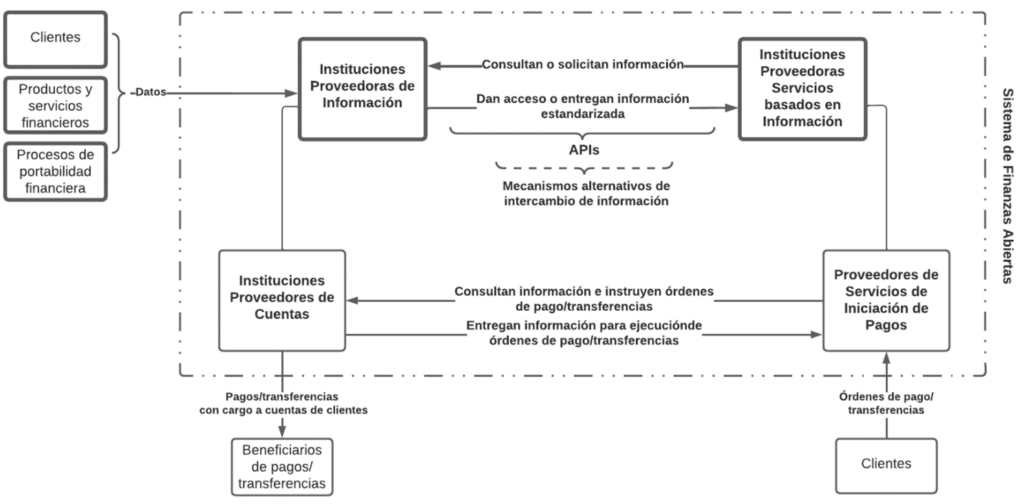

The recently approved Fintec Law creates the Open Finance System (SFA), whose objective is to promote competition, innovation and inclusion in the financial system, facilitating the exchange of information between different service providers in this field.

This will occur through remote and automated access interfaces–known as application programming interfaces or “APIs”—, which will enable direct interconnection and communication between said providers without the need for a contractual relationship that binds them.

The SFA will function under the supervision and oversight of the Commission for the Financial Market (CMF) . It will correspond to it to dictate the regulation and instructions necessary for its adequate implementation and operation, as well as to supervise the fulfillment of the obligations of its participating institutions.

Below, we describe the main aspects of the operation of the OSS, including the information it will contain, the institutions that will participate in it and their roles, and the main deadlines established by law.

- What kind of information will be exchanged?

The Fintec Law establishes a non-exhaustive list of information that must be exchanged through the SFA:

- Information on general terms and conditions of financial products and services, and on customer service channels.

- Identification information and registration of clients of financial products and services and their representatives.

- Information on the commercial conditions contracted and the history of transactions of clients of financial products and services, such as checking, sight, provision of funds and savings accounts, credit cards, insurance policies, savings or investment instruments and operation services cards and similar means of payment.

- Communications between financial providers for purposes of financial portability.

- Data or information necessary for the provision of payment initiation services.

- Other data or information related to financial products or services or initiation of other types of transactions that the CMF may define through a general rule.

While the information in points (i) and (iv) must be available in open data formats, that in points (ii), (iii), (v) and (vi) may only be shared to the extent that the respective clients have previously authorized it.

2. What type of institutions will participate?

The Fintec Law defines 4 categories of participating institutions:

- Information Provider Institutions – are those that generate the information that will be available through the OSS, so their participation is mandatory. This category includes, among other institutions, banks, issuers and operators of cards or other means of payment authorized by the CMF, savings and credit cooperatives, insurance companies, general fund managers, stock brokers and compensation funds.

- Information-Based Service Provider Institutions – are those that may consult, access and receive data from the Information Provider Institutions through the OSS. Although their participation is voluntary, as a general rule they must register in advance in a special registry in charge of the CMF. As an exception, duly authorized Information Provider Institutions and Financial Service Providers will not require new registration, but they will be subject to compliance with the same requirements applicable to entities whose participation is voluntary.

- Payment Initiation Service Providers – are those that provide services to clients holding checking, sight or fund accounts, consisting of the instruction (on behalf of these clients and before Account Provider Institutions) to execute payment orders or transfers electronic funds charged to their respective accounts and means of payment. To operate legally, these entities must be registered in a special registry in charge of the CMF.

- Account Provider Institutions – are the banks and financial institutions that provide checking, sight or fund accounts. Although they already qualify as Information Provider Institutions, the Fintec Law has specifically defined them to regulate their relationship with Payment Initiation Service Providers within the framework of the SFA. Their participation in the latter is therefore mandatory.

Diagram No. 1. Roles of the institutions participating in the OSS.

3. Will there be charges associated with its operation?

Information Provider Institutions may not charge Information-based Service Providers for the communication of customer data information requested through the SFA APIs. This, with the exception of the reimbursement of the direct incremental costs that must be incurred to meet the number of requests over the thresholds that the CMF must define based on public, objective, equitable and non-discriminatory conditions among the participating institutions.

The aforementioned requests for information may not give rise to the collection of commissions or additional charges to clients.

4. When will you start operating?

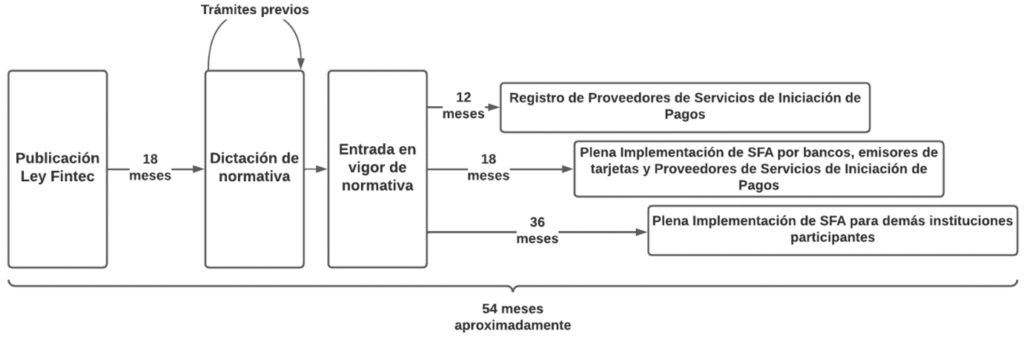

The CMF must issue the necessary regulations for the gradual implementation of the OSS within a period of 18 months from the publication of the Fintec Law in the Official Gazette. This regulation will be subject to prior public consultation procedures, regulatory impact assessment and reports from the National Economic Prosecutor’s Office.

Although the process will be gradual, the Fintec Law has also established certain maximum deadlines to complete the implementation. Counted from the entry into force of the regulations issued by the CMF, there will be 12 months for the registration of the entities that on the date of entry into force of the Fintec Law are providing Payment Initiation Services; 18 months for the full operation of the OSS in banks, card issuers and Payment Initiation Service Providers; and 36 months for full operation in the other participating institutions.

Diagram No. 2. Main terms of the SFA.

The SFA means a relevant step for the country on the path of open finance , so it is foreseeable that its operation will entail significant challenges for the participating institutions. Do not hesitate to contact us if you want to know more about the Fintec Law or its related topics.

For more information contact:

Natalia Gonzalez | Associate Group az Tech | ngonzalez@az.cl

Rodrigo Albagli | Partner Albagli-Zaliasnik | ralbagli@az.cl

Francesca Franzani | Compliance Group Director | ffranzani@az.cl